Market Insights: Precious Metal Performance

Milestone Wealth Management Ltd. - Dec 12, 2025

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index closed 0.69% higher. In the U.S., the Dow Jones Industrial Average rose 1.05% and the S&P 500 Index decreased 0.63%.

- The Canadian dollar increased this week, closing at 72.65 cents vs 72.26 cents USD last week.

- Oil prices were down this week, with U.S. West Texas crude closing at US$57.45 vs US$60.15 last week.

- The price of gold jumped this week, closing at US$4,330 vs US$4,205 last week.

- In the U.S. the Federal Reserve delivered its third straight 25 bp rate cut, bringing the federal funds rate to 3.50%–3.75%, but signaled a much slower easing path ahead, with the new dot plot projecting just one cut in 2026 and one more in 2027 as inflation remains near 3% and above target. Policymakers now see PCE inflation gradually easing back toward 2% by 2027, while unemployment edges down modestly. Chair Powell emphasized that policy is now within the neutral range, giving the Fed room to “wait and see” how tariff-driven inflation and a cooling labour market evolve, while reiterating the Fed’s commitment to restoring 2% inflation without tipping the economy into a sharper downturn.

- The U.S. trade deficit unexpectedly narrowed to $52.8B in September—the smallest since mid-2020—as exports surged $8.4B while imports rose only modestly, leaving the deficit $27B smaller than a year ago and the “real” goods gap nearly $20B narrower, a shift that will support Q3 GDP after trade dragged heavily earlier in the year. Though the improvement aligns with the Administration’s focus on boosting domestic production, overall trade volumes remain subdued and well below early-2025 peaks, making it unclear whether the trend reflects reshoring and supply-chain shifts or simply softer global demand; meanwhile, China has slipped to a distant third among U.S. import sources, and the U.S. posted its 43rd straight month as a net petroleum exporter, hitting a record spread in September.

- The Bank of Canada held its policy rate at 2.25%—a widely expected pause reinforced by stronger-than-anticipated Q3 GDP, resilient job gains, and inflation drifting just above 2%—with Governor Macklem noting the economy has weathered tariff shocks better than feared thanks to upwardly revised growth in prior years and limited spillover beyond targeted sectors. While consumer spending and business investment remain soft and households still feel strained by living costs, the Bank signaled rates will stay on hold through 2026 as ample economic slack keeps inflation contained, though officials cautioned that uncertainty around U.S. tariffs and next year’s CUSMA renewal remains a key risk to the outlook.

- The takeover fight for Warner Bros. Discovery intensified as Paramount Skydance unveiled a $108B all-cash bid for the entire company — far larger and simpler than Netflix’s $72B cash-and-stock offer for only the studio and streaming assets. Paramount argues its fully backstopped financing and single-entity purchase reduce regulatory and execution risk, especially after Trump flagged antitrust concerns about a Netflix-WBD merger. The offer sent WBD and Paramount shares higher, pressured Netflix stock, and positions Paramount as the potentially cleaner path to closing compared with Netflix’s more complex, multi-jurisdictional review.

- Disney announced a landmark 3-year, $1B investment and licensing deal with OpenAI that allows Sora and ChatGPT Images to generate videos using Disney’s iconic characters (Star Wars, Pixar, Marvel, Mickey, etc.) starting early next year—part of a broader strategy to integrate generative AI into Disney+ content creation, internal film production, and employee tools. The partnership includes equity warrants for Disney, strict guardrails to prevent inappropriate character use, and a plan for select user-generated videos to stream on Disney+. While Disney frames the deal as a “responsible” expansion of storytelling, Hollywood unions reacted cautiously, raising compensation and IP concerns and warning that AI-generated media could weaken creators’ leverage despite assurances from Disney and OpenAI.

- The Depository Trust & Clearing Corporation (DTCC) received a key SEC “no action” letter allowing its Depository Trust Company subsidiary to launch a blockchain-based tokenization service for stocks, ETFs, and bonds starting next year—a three-year approval window that paves the way for 24/7 trading, instant settlement, and lower transaction costs. The move marks one of the strongest regulatory signals yet that tokenized traditional assets are moving toward mainstream adoption, with full-service details expected in the months ahead.

Weekly Diversion:

Check out this video: He Looks Familiar!

Charts of the Week:

Precious metals periodically remind investors that even assets with no cash flow can dominate performance tables when the right macro and market conditions align. Their price moves tend to come in powerful, compressed bursts, often rivaling or surpassing the gains of high-flying growth equities over a single year. This dynamic raises important questions about the role of such assets in diversified portfolios, the durability of their value, and how they compare with both traditional “commodity-like” technology names and more conventional equities.

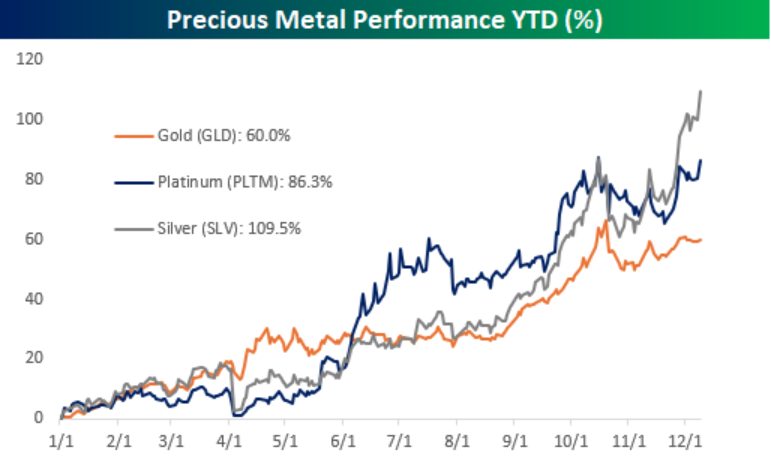

This year (as of Wednesday, December 10th), gold rose about 60%, platinum advanced roughly 86%, and silver surged by approximately 110% as this chart below highlights, putting these metals in the same conversation as the strongest individual stocks in major equity indices. Such moves compress extraordinary capital appreciation into a short window, challenging the notion that investors must always look to growth companies for outsized returns.

Source: Bespoke Investment Group

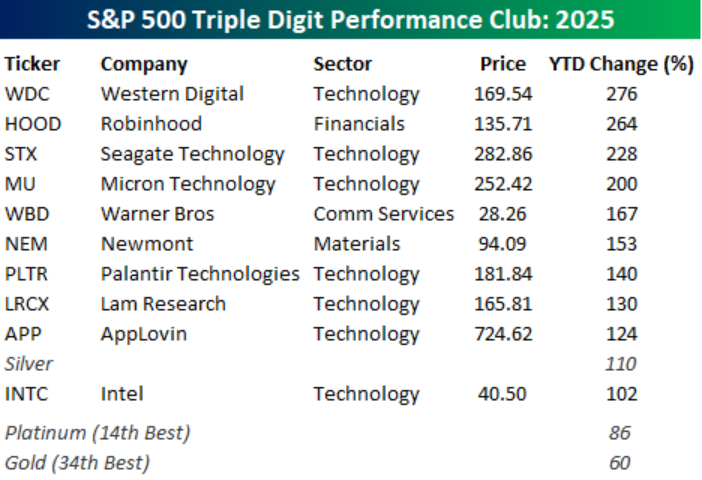

The juxtaposition with leading index constituents is especially striking when a metal’s annual gain rivals that of the best-performing stocks in a broad benchmark. In such periods, a metal might slot directly into the top tier of performers, shoulder to shoulder with high-momentum technology names or cyclical winners, despite offering neither earnings nor innovation, as shown in the next table. Silver’s jump of around 110% would place it among the very best performers in a large-cap index, effectively sitting near the tenth spot in a ranking of annual returns and ahead of many well-known technology names. Platinum’s gain in the mid-80% range would rank in the low teens, while gold’s roughly 60% appreciation would still secure a place within the top few dozen constituents by performance. This pattern underscores that, over a single year, non-yielding metals can rival or exceed the return profile of innovative, cash-generating businesses.

Source: Bespoke Investment Group

For practitioners, the lesson is not that precious metals or commodity-like tech names should dominate strategic allocations, but that their episodic surges can meaningfully reshape performance attribution and risk narratives in a given year. Incorporating such assets thoughtfully—recognizing their tendency toward boom-and-bust cycles, their lack or presence of cash flow, and their differing long-horizon risk profiles—can enhance diversification without relying solely on traditional style boxes.

Sources: Yahoo Finance, Reuters, Fox Business, First Trust, CBC, Bespoke Investment Group

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.