Market Insights: Broadening Leadership and Improving Market Breadth

Milestone Wealth Management Ltd. - Jan 23, 2026

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index closed 0.32% higher, while in the U.S., the Dow Jones Industrial Average fell 0.70% and the S&P 500 Index declined 0.42%.

- The Canadian Dollar increased this week, closing at 72.95 cents USD vs. 71.79 last week.

- Oil prices rose again, with U.S. West Texas Crude closing at US$61.29 vs. US$59.28 last week.

- The price of Gold jumped to another all-time high this week closing at US$4,981 vs. US$4,588 last week.

- Silver also closed at an all-time high this week at US$102.54.

- U.S. consumers continued to show healthy, market-driven momentum under a pro-growth economic backdrop, with spending rising 0.5% in November and real consumption up 2.6% year over year, signaling healthy demand heading into the holiday season. Private-sector wages continued to lead income growth, reinforcing a shift away from government transfers and toward market-driven earnings. Inflation stayed well-behaved, with core PCE rising just 0.2% on the month, supporting the view that growth is being achieved without reigniting inflation. Combined with subdued rent pressures and restrained money supply growth, the data point to an economy benefiting from stronger incentives for work, production, and consumption—consistent with a durable expansion rather than stimulus-driven growth.

- U.S. economic momentum strengthened further in Q3, with real GDP revised up to a robust 4.4% annualized pace — the fastest growth in two years — underscoring the durability of the expansion under a pro-growth policy backdrop. The upward revision was driven by stronger business investment, inventories, and net exports, while corporate profits surged, rising 4.5% quarter over quarter and more than 9% year over year, highlighting healthy business fundamentals. Even beneath the headline, core GDP grew at a steady 2.9% rate, closely in line with the long-term pre-COVID trend, signaling sustainable, private-sector-led growth rather than an overheated economy. Nominal GDP climbed at an impressive 8.3% annual rate, reinforcing strong income generation across the economy, while jobless claims remain low — a combination that points to continued economic resilience and flexibility for growth going into 2026.

- Canadian retail sales jumped 1.3% in November to $70.4B, led by a broad-based rebound across categories, with core sales up 1.6% and food & beverage retailers surging after B.C. labour disruptions eased, according to Statistics Canada. While advance data point to a 0.5% pullback in December, economists note this reflects continued sideways—but resilient—consumer activity, with November’s strength highlighting pockets of pent-up demand rather than a deterioration in household fundamentals.

- Ontario Premier Doug Ford forcefully condemned Ottawa’s decision to allow up to 49,000 Chinese-made electric vehicles into Canada at reduced tariffs, arguing it threatens Canadian auto jobs, weakens supply chains, and risks damaging relations with the U.S. Ford went further by raising national security concerns, claiming the vehicles could be used to monitor Canadians’ phone calls and data, likening the move to “Huawei 2.0.” He warned that even a limited quota gives China a dangerous foothold in the market, saying “once the camel gets its head in the tent, the whole body follows,” and questioned whether the U.S. would tolerate Chinese-connected vehicles crossing the border, U.S. Transportation Secretary Sean Duffy said they would not be allowed to enter the United States. Prime Minister Mark Carney downplayed those concerns stating it was only 3% of the total market, but Ford emphasized that it represents 33% of EV Sales in Canada, maintaining that the deal is a long-term mistake Canada will regret.

- GFL Environmental will move its corporate headquarters from Vaughan to Miami, affecting roughly a dozen roles, as part of a strategy to broaden its shareholder base and qualify for major U.S. equity indices. Management emphasized that the decision reflects the U.S. as an “attractive market” where more than two-thirds of GFL’s revenue is already generated, improving access to highly skilled talent while maintaining Canadian operations, Ontario incorporation, a TSX listing, and shared services hubs in Vaughan and Raleigh.

- TikTok secured its future in the U.S. after finalizing a landmark, Trump-backed deal that places the platform firmly under American control. The new joint venture gives U.S. investors 80.1% ownership, satisfying national security concerns while preserving access for 200 million American users and 7.5 million businesses that rely on the platform for growth and commerce. Backed by major U.S.-aligned partners Oracle, Silver Lake, and MGX, the deal ensures U.S. data, algorithms, and cloud infrastructure are housed domestically under Oracle’s oversight. The agreement marks a rare win-win outcome: safeguarding national security, protecting small businesses and creators, and reinforcing America’s ability to set the rules for global tech platforms—without shutting down innovation or consumer choice.

Weekly Diversion:

Check out this video: Even though it’s cold, it could be worse

Charts of the Week

The recent evolution of equity markets can be understood as a gradual shift from narrow, momentum-driven leadership toward a more balanced and healthier breadth across multiple sectors and styles.

Broadening Leadership

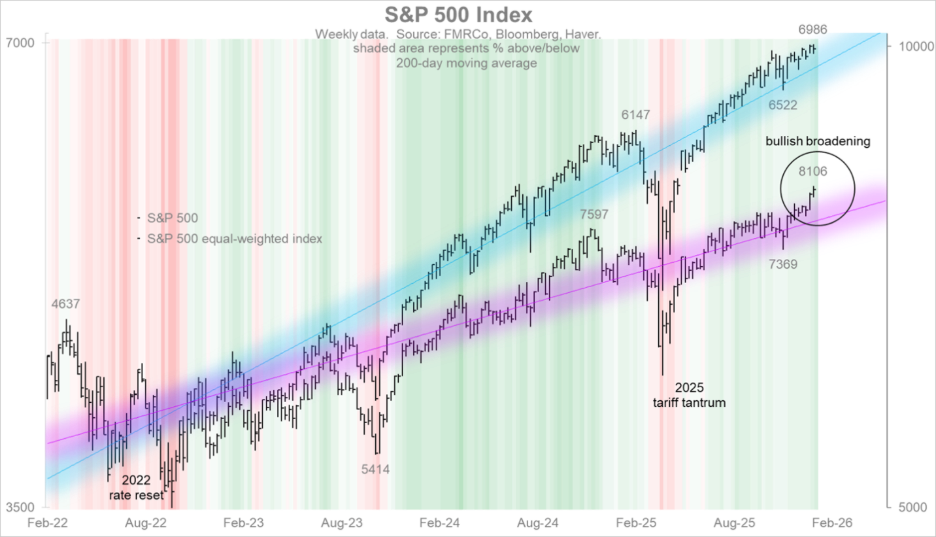

The S&P 500 Index chart below, with its shading around the 200-day moving average, shows a powerful recovery from a sharp drawdown (tariff tantrum), followed by a sustained advance that has pulled prices above key trend measures. Importantly, the equal-weighted version of the same benchmark (highlighted in purple) has begun to close the gap with the cap-weighted index (highlighted in blue), indicating that gains are no longer confined to a small group of mega-cap companies but are instead spreading through the market. This broadening of performance helps reduce single-stock and single-theme risk, suggesting a sturdier foundation for the current cycle.

Source: FMRCo, Bloomberg, Haver, via Fidelity Investments

Improving Market Breadth

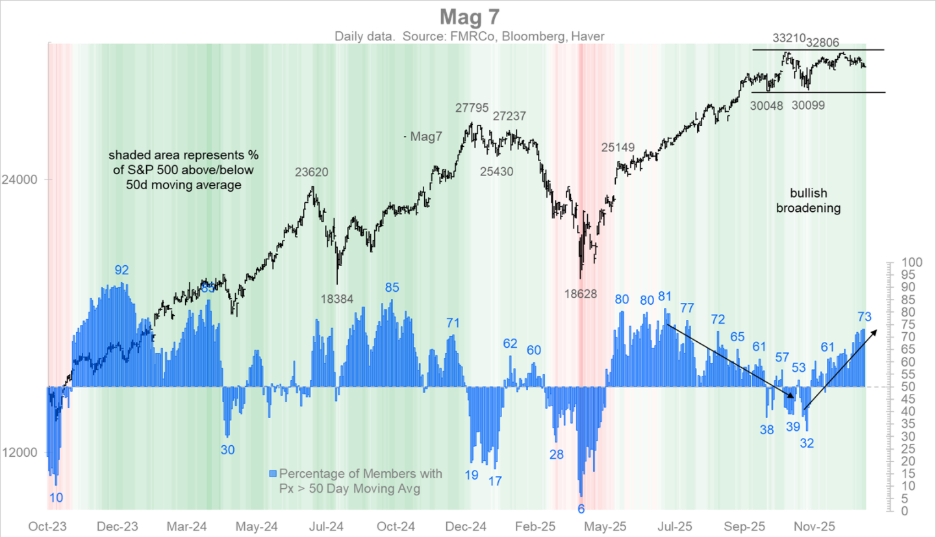

The following market breadth chart, which tracks the percentage of index members trading above their 50-day moving average (bars in blue), reinforces this narrative of healthier participation. Where breadth had previously languished near the low 30% range, it has climbed into the 70%+ zone, illustrating that a clear majority of stocks now participate in the uptrend rather than a narrow leadership cohort. At the same time, the range-bound pattern in the largest technology-oriented names known as the ‘Mag 7’ (black line) suggests a pause in their dominance as capital rotates into lagging areas, further confirming a more inclusive advance.

Source: FMRCo, Bloomberg, Haver, via Fidelity Investments

Momentum Across Segments

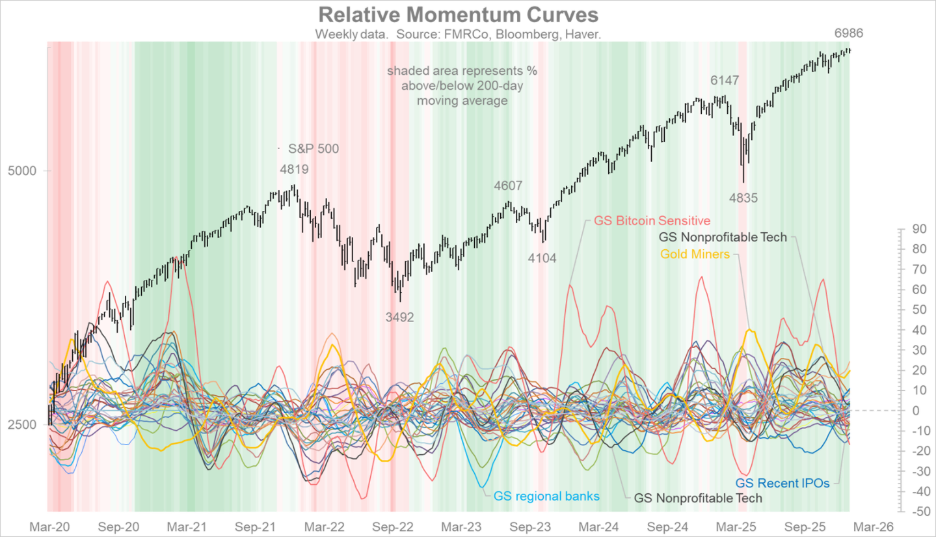

The relative momentum curves provide a cross-sectional view of how different equity “pockets” are behaving versus long-term trend measures. Earlier in the cycle, speculative growth segments such as nonprofitable technology and recent IPOs swung dramatically above and below their 200-day moving averages, creating pronounced outliers and fueling bubble narratives. More recently, those extremes have moderated while commodity-sensitive equities and other cyclically exposed areas show the strongest upside momentum, implying a more balanced opportunity set rather than a single sector dominating returns.

Source: FMRCo, Bloomberg, Haver, via Fidelity Investments

Earnings and Valuation Mix

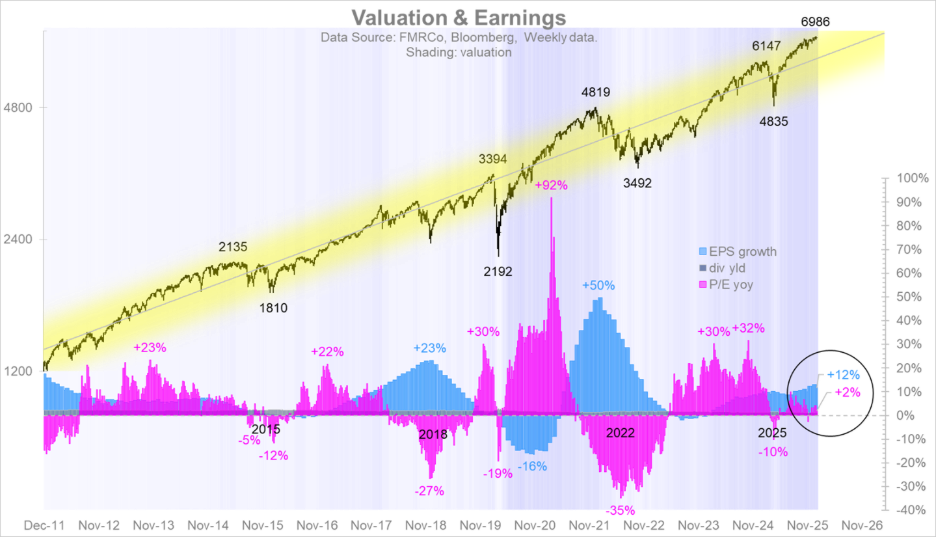

The next valuation & earnings chart highlights a crucial shift in the drivers of total return. Over the most recent 12-month period, earnings per share (EPS) growth has contributed to the bulk of index gains; around low double-digit percentage points, while price-earnings (P/E) multiple expansion (the multiple of earnings that participants are willing to pay for a company) has played only a modest supporting role. This stands in contrast to earlier phases of the current cyclical bull market (like 2023 and 2024), when rising price-to-earnings ratios did much of the heavy lifting, and it points to a market increasingly underpinned by fundamental profit growth rather than purely by investors’ willingness to pay higher valuations.

Source: FMRCo, Bloomberg, Haver, via Fidelity Investments

From Boom Fears to Balanced Cycle

Taken together, these charts argue more for a vigorous boom than an overstretched bubble. The price path bears some resemblance to past powerful advances, yet the breadth, segment momentum, and valuation mix appear less extreme than during prior episodes of speculative excess. In such an environment, the central challenge for investors is not merely to chase the strongest index but to maintain a disciplined, diversified allocation that respects improving breadth, recognizes shifting leadership, and remains anchored in underlying earnings power rather than headline noise.

Sources: Yahoo Finance, First Trust, Fox Business, City News Toronto, The Canadian Press, Reuters, Investing.com, StatsCan, FMRCo, Bloomberg, Haver, Fidelity Investments

©2026 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.