Market Insights: S&P 500 and the Golden Cross

Milestone Wealth Management Ltd. - Feb 04, 2023

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index was up 0.21%. In the U.S., the Dow Jones Industrial Average was down 0.15% and the S&P 500 Index rose 1.62%.

- The Canadian dollar decreased this week, closing at 74.65 cents vs 75.13 cents last Friday.

- Oil prices declined this week. U.S. West Texas crude closed at US$73.39 vs US$79.41 last Friday, and the Western Canadian Select price closed at US$50.77 vs US$55.71 last Friday.

- The gold price weakened this week, closing at US$1,864 vs US$1,928 last Friday.

- This week, the U.S. Central Bank took centre stage, making its latest rate announcement on Wednesday. The Federal Reserve boosted the federal funds rate by 0.25%, taking its target range to 4.50% - 4.75%, the highest since October 2007. The post-meeting statement noted that inflation “has eased somewhat but remains elevated” and gave little indication it is nearing the end of this hiking cycle.

- Canada’s GDP grew by 0.1% in November and an early estimate by Statistics Canada suggests that the economy was flat in December. Overall, the preliminary data points to annualized growth in Q4 of 1.6%, a slower pace than the 2.9% annualized pace in Q3, 3.2% in Q2, and 2.8% in Q1 of 2022.

- Imperial Oil (IMO) reported better than expected earnings of $2.86/share vs $2.57/share expected, with revenue of $14.45 billion vs $17.55 billion expected. The earnings release comes just days after announcing that the company is moving forward with a $720 million project to build a renewable diesel facility at its Strathcona refinery near Edmonton.

- TC Energy (TRP) announced updated cost estimates for the Coastal GasLink Project following a comprehensive cost and schedule risk analysis. The company's new estimate of the costs to complete the project has increased to approximately $14.5 billion.

- Earnings were released from some of the big and most closely watched tech companies this week:

- Meta Platforms (META), Facebook’s parent company, released earnings after the market closed on Wednesday with above expected revenue of $32.17 billion vs $31.53 billion expected. The company also announced a $40 billion stock buyback program.

- Apple (AAPL) reported after the close on Thursday, missing expectations with earnings of $1.88/share vs $1.94/share estimated, down 10.9% year-over-year. Revenue came in at $117.15 billion vs $121.10 billion estimated, down 5.49% year-over-year, with all-important iPhone revenue at $65.78 billion vs. $68.29 billion estimated, down 8.17% year-over-year.

- Amazon (AMZN) also reported on Thursday, with earnings of $0.03/share for the quarter, with higher-than-expected revenue of $149.2 billion vs $145.42 billion expected.

- Alphabet (GOOGL), Google’s parent company, also released their earnings after the close on Thursday, coming in below expectations with earnings of $1.05/share vs $1.18/share expected, and revenue of $76.05 billion vs $76.53 billion expected.

- On Friday, the U.S. jobs numbers were released showing surprising resilience in the labour market despite signs of a slowing economy in other statistics. Nonfarm payrolls increased by 517,000 for January, far higher than the 187,000 estimate. The unemployment rate fell to 3.4%, lower than the estimate for 3.6% and the lowest jobless level since May 1969.

- The ISM Non-Manufacturing index increased to 55.2 in January, well above the expected 50.5 (Levels above 50 signal expansion; levels below signal contraction.) The index measures the service sector in the US and is a large factor for GDP measurements.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer titled Our Take on a Wild Week: Dwyer VLOG

Weekly Diversion:

Check out this video: The building of the future or just another crazy idea?

Charts of the Week:

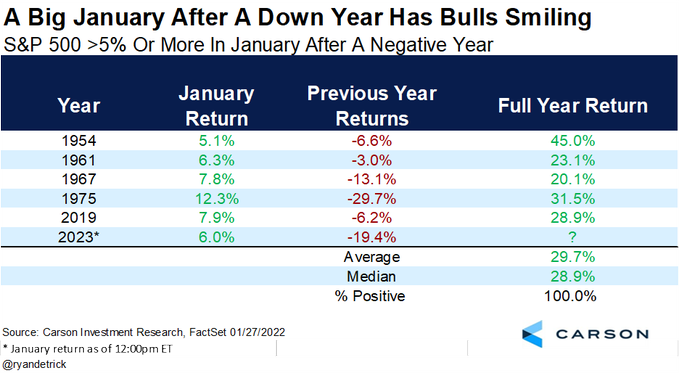

In a follow-up to last week’s Charts of the Week, we wanted to highlight the performance of the S&P 500 for the month of January. As we discussed last week, positive returns for the month of January after a year of declines has historically proven to be very beneficial for investors, although recognizing a limited sample size. On Tuesday, the S&P 500 closed out the month of January, up 6.62%, and looking at historical full year returns after a similar occurrence, we can see the average return for the rest of the year comes in just under 30% after a January with an over 5% monthly return. The scenario has only played out 5 times since 1954 but we remain hopeful that 2023 will play out with similar results.

Source: The Chart Report

The news for the S&P 500 gets better when we observe the following chart and table below. The chart and table reference situations of Golden Crosses since 1945. A Golden Cross measures a period where a short-term average moves above a longer-term average and is considered an important measure as it often predicts a turning point in a down market. The most popular Golden Cross is the 50-day moving average compared to the 200-day average, however, the table and chart below review past instances of the 3-month moving average crossing the 10-month average. As we can see, these occurrences have always resulted in positive 1-yr and 3-yr returns and all but one positive return over a 2-yr period. More impressive is that the average returns after these historical signals with the 1-yr average at 17.02%, the 2-yr average at 25%, and the 3-yr average at 33.82%. Time will tell if 2023 will bring a similar rally, especially considering the Event Dates noted in the table have occurred very near or shortly after recessionary long-term lows.

Source: The Chart Report

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges.

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, Bespoke Investment Group, First Trust, Seeking Alpha, The Chart Report